The commute used to be my favorite part of the day. Headphones in, reading a book, riding a bus, getting a half-hour or more of walking in before I started the day, these were moments I can look back on fondly. No family, no meaningful work getting done, just being shoulder to shoulder, alone in a crowd. Now I have a different morning routine: working from home. Ideally, I never want to go back to the two-hour commute across the Columbia from my home in SW Washington. And I'm not alone. Many knowledge workers began working from home full-time in March 2020. Even before then, for Southwest Washington residents that worked for companies across the border in Portland, working from home presented and opportunity to lower Oregon tax liability dramatically. This is a report on how I filed and refiled my Oregon taxes to get money back.

This issue of cross-border tax liability has been the subject of news articles from time to time. The rules as of this writing are simple: you only owe tax on income made during days you were physically present in Oregon. The headquarters of the business being in Oregon do not matter; liability only attached if you were physically present in the state. For those of us that live in states without an income tax, unless your accounting department is filing on your behalf in your state of residence, your Oregon company will likely be withholding Oregon taxes from your check. Come tax time, getting this back takes some legwork, but can increase your net income at the measly cost of a few minutes of your time each month.

The tools for getting your Oregon tax refunded are simple:

- Get a Statement from your Employer

- Make a Location Log

- Calculate your Liability through Formulas

- Fill out the OR-40-N

- File with the Oregon Department of Revenue

- Wait a Long Time

Get a Statement from your Employer

Some employers, like contractors or event businesses that move workers around from site to site, may keep track of where work was performed on your behalf. However, a large number of knowledge-based businesses like software companies will not have the inclination to do this kind of tracking. Should this be the case, obtaining your log may be as simple as asking your Human Resources department for this data.

However, the Department of Revenue may still request an affirmative statement from your HR that they do not track work from home days. I obtained this by sending an email to my HR asking for such a statement. They responded to that email that it was incumbent upon the employee to keep track of those days. I made a PDF copy of that email thread, and I included it with each filing for the past few years. This seems to have satisfied the requirements of the Oregon Department of Revenue (hereafter, DOR), and they have not bugged me for a more official record than my personal log.

Make a Location Log

The wages shown in the Oregon column of your amended return differ from the Oregon wages reported on your Form W-2. Please provide a statement from your employer indicating the following:• Total days actually worked.

• Number of days worked in Oregon.

• Number of days worked outside Oregon (identify the other state).

• Number of vacation days.

• Number of sick days.

• Number of holidays.

Practically, this meant I needed to track Oregon, Washington, Sick, Vacation, Holiday, and Weekend/Off days. Out of an abundance of caution, I counted a day as an Oregon Day even if I was only in the office for a brief period of time as traffic is never kind to the commuter. If done as a journal, keeping this record should be no more time consuming than reviewing your timesheets or balancing a checkbook (and can be done as frequently). I set a reminder on my personal calendar app to keep it updated.

If you are refiling, you may need to assemble this log from your recollection, business records like email and chat conversations, or your location record from the likes of Google. That's right, you can finally put insidious and pervasive surveillance to good use! Google Maps provides a way you can look back through your location history. Note the days you made the trek across the bridge and back. If a day is not recorded, you can search in most business chat programs like Slack for chats on a specific date. After you're done, it may be a good time to run through a personal surveillance self-defense exercise courtesy of the EFF.

- To start, I create a sheet names Log, added a Title row with "Date" and "Location" columns. I put full dates in the Date column, one line per day, from January 01 to December 31. When I refiled, I made a new sheet for each year. It may help to add a column with the day of the week to help keep you on track.

- As I work a normal Monday through Friday schedule, I noted the weekends on the sheet next and marked them all in the second column as "Weekend". Those with irregular schedules can mark them as "Off". Prefilling gave me a visual reminder that kept my days and dates from getting off due to leap years and accidental missing days.

- I then added the company holidays as observed and marked those days as "Holiday". This was important to differentiate days that were paid for by the company versus days paid from PTO.

- I completed the preliminaries by adding "Sick" and "Vacation" days from personal calendars and notes to my manager.

- Using my location history and business records, I completed the log by adding Oregon days and Washington days to the sheet. Again, to be careful, I counted a day as an Oregon Day once I stepped foot in the state.

Calculate your Liability through Formulas

As an employee of a SaaS company, I realize that the biggest competition is a spreadsheet. The formulas available to you are simple and can save you time, but there are also pitfalls. A few ways to prevent bad data entry and double-check your numbers without counting everything by hand are also included.

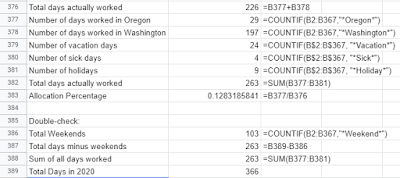

Here is a step by step to calculating your liability based on a log. Formulas in the above picture are for my sheet and may not apply to yours.

- On a separate sheet or at the bottom of your log, add one line for each of the days that the DOR wants you to track: Oregon, Washington, Sick, Holiday, Vacation, Weekend/Off

- Familiarize yourself with how the formula COUNTIF works. Generally, you are counting the occurrence of a string in a range of data. The formula =COUNTIF(B2:B367,"*Oregon*") would return the number of cells in the B column cells 2 through 367 that had the word "Oregon" in it. The asterisks will help you include cells where you said "Oregon Day", used all caps, or left trailing spaces, but they would not count typos like "Worshington".

- Add an =COUNTIF() for each of the types in the next column over. The range should match your Location column. The criteria should be one of the types you've picked out earlier: Oregon, Washington, Sick, Holiday, Vacation, Weekend/Off.

- Add a summary line for Total Days Actually Worked. Add all state work days (for me, Oregon and Washington only, but it may be different for you). For the definition of "Total days actually worked", I refer to a letter I received from the DOR:

(The "number of days worked in Oregon" plus the "number of days worked outside Oregon" must equal the "total days actually worked". Holidays, vacation days, and sick days aren't days worked and shouldn't be included in those numbers.)

- Double-check your numbers by adding up all types of days (Oregon, Washington, Sick, Holiday, Vacation, Weekend/Off). At the end of the year, this should add up to 365/366. If it doesn't, check your formulas for errors, and check your cells for typos. Don't tear your hair out too long. Counting by hand is perfectly reasonable. Sometimes computers are just dumb and bad.

- Calculate your liability percentage by taking your Oregon Days and dividing by your Total Days Actually Worked. This will give you the percentage of income that is considered Oregon Income for the purposes of filing taxes.

- Calculate your Oregon Allocated Income by multiplying the gross income on your W-2 times your liability percentage. This will give you the amount of income that is considered Oregon Income for the purposes of filing taxes. This is the number that goes on your state tax return (probably line 7S).

Fill out the OR-40-N

You will probably want to file your returns through the mail. Unfortunately, I have not found any tax program like H&R Block or similar that can handle allocated income to my satisfaction. The notes fields where Total Days Actually Worked and similar data can be included are not available to you when e-filing. As I have preferred to file reduced Oregon income with as much documentation as possible, this has forced me to send in current year returns in printed form. This has not affected how I file my federal return, however. Some programs will allow you to fill out your Oregon return, change the Oregon income amounts, and calculate your liability that way. They then will print or asave a PDF of your state return for filing by hand. This was not as helpful for refiling, however.

The form used by Oregon for non-residents is OR-40-N. This form and the instructions that go along with it are available from the DOR's forms site. Read them carefully! Rather than repeating their instructions, I will give you a few helpful pointers when filing and refiling:

- As of this writing, the allocated Oregon income goes in field 7S. This should be less than the Federal Column 7F

- The change to your allocated income will ripple through the rest of document. The next notable fields that will change is your Total Income (20S), Income after adjustments (29S), Income after Additions (31S), and Income after Subtractions (34S).

- Your Oregon percentage will be your actual percentage income difference between state and federal. Your Oregon Deductions and Modifications will be multiplied by your Oregon percentage on line 42. So make sure you get this number right. This will in turn feed into line 46, your Oregon Taxable Income

- Line 46 will change your Oregon Tax dramatically. Oregon uses a tax bracket system, but the instructions have distilled it down to only a few steps:

- Find the percentage threshold your income reaches.

- Subtract that threshold from your Oregon income and multiple what's left by your tax rate.

- Add a threshold tax amount and your calculated amount together to get the total tax you'll pay.

- The rest of the form covers credits and carries all of your changes you made above. If you are refiling, your Kicker and similar credits will reflect the taxes you've already filed, payments you've made, and refunds you've already received. If you have received a Kicker payment and want to refile, make sure to have all the documentation available for those payments.

- If Refiling, complete the Amended Statement on the last page of the return. This is where you can include the different categories of days. When I refiled, my statement was a little confusing and they asked for supporting documentation before they finished my return. See the DOR account section below for details on how to do that.

Above all else: Remember to sign your return! An unsigned return will be rejected, and you will need to wait even longer for your money back!

File with the Oregon Department of Revenue

Once you have this done, create a cover letter for your tax submission. For initial filing, I put my "Total Days Actually Worked" matrix in a letter instead of on my return. This collected all my allocated income data in one easy to read place. I also included some contact information in case things got lost, went amiss, or they needed to get ahold of me. Then I collected everything I had and put it into a big manila envelope and slapped at least $2 worth of stamps on there:

- OR-40-N, SIGNED

- Copy of W-2s or other supporting tax documents

- Cover Letter containing Total Days Actually Worked, Oregon Days, Washington Days, Sick, Vacation, Holiday

- Location Log copy

- HR statement if you've got one

Wait a Long Time

This is an important step over which you have little to no control. Filing using paper can take up to two months to start processing. Refiling can take over six months until a refund is issued. Be prepared to wait. The DOR people are courteous, and they can be reached by phone if you are worried your return is lost. To assuage your fears and speed up resolution of requests for more data, set up a DOR account on Oregon's Revenue Online portal. You can even give your tax pro access to the portal on your behalf. Requests for submissions and letters from the DOR about your return will be visible in the portal long before they hit your mailbox. When your return is processed by not issued yet, you will see your account balance change on the portal first as well.

The Pay-off

For Washingtonians, living across the river can be a pain. But getting some of your money back by reducing your liability can help ease the sting. Especially in this new age of Work From Home, every economy is going to have to readjust to the reality of people not commuting quite as much. Maybe the lack of a commute means you move out even farther to where the internet stops? Maybe you move closer in to your favorite Downtown area and abandon cars altogether in favor of walkable cities with fiber access? Either way, you now have a bit more scratch to bring to bear to make either dream possible.

Side-notes

Federal Deductions: If you itemize deductions, Oregon Tax changes may change your tax deductions on your federal return for the following year. If this is the case for you, talk to a tx professional about unwinding that problem.

Working in states that ALSO have an income tax might further complicate things. Talk to a tax professional to sort that out. They might also benefit from your location log, or they could have completely bonkers requirements. At any rate, pay someone to make sure you get it right.

If you were reading this hoping to find some anti-tax screed, I apologize. Pay your fucking taxes, you wanker. And if you don't like how your taxes are being used, then still pay your taxes and then vote. It actually helps.